Community CPA is not your average accounting firm. We offer expertise with empathy, knowledge, and powerful technology.

These issues are more common than many taxpayers realize. In most cases, they can be resolved efficiently with the right approach and timely W-2 correction help.

Gain instant access to a comprehensive library of free webinars. Whether you're managing personal finances or a growing business, our accounting experts have you covered.

Our team provides expert guidance tailored to your goals. Book an appointment to discuss your individual or business accounting needs.

Properly perform a financial or special purpose audit with our help. We’ll ensure you master compliance requirements.

Plan for the future with an estate plan that aligns with your goals and minimizes tax liability.

Business technology consultation for streamlining your business processes.

Our dedicated team of accounting experts is here to help you navigate your unique financial challenges. Schedule a one-on-one consultation today.

Subscribe to our YouTube Channel and never miss one of our free accounting webinars! Join us live on Tuesdays and Saturdays at 3pm CT.

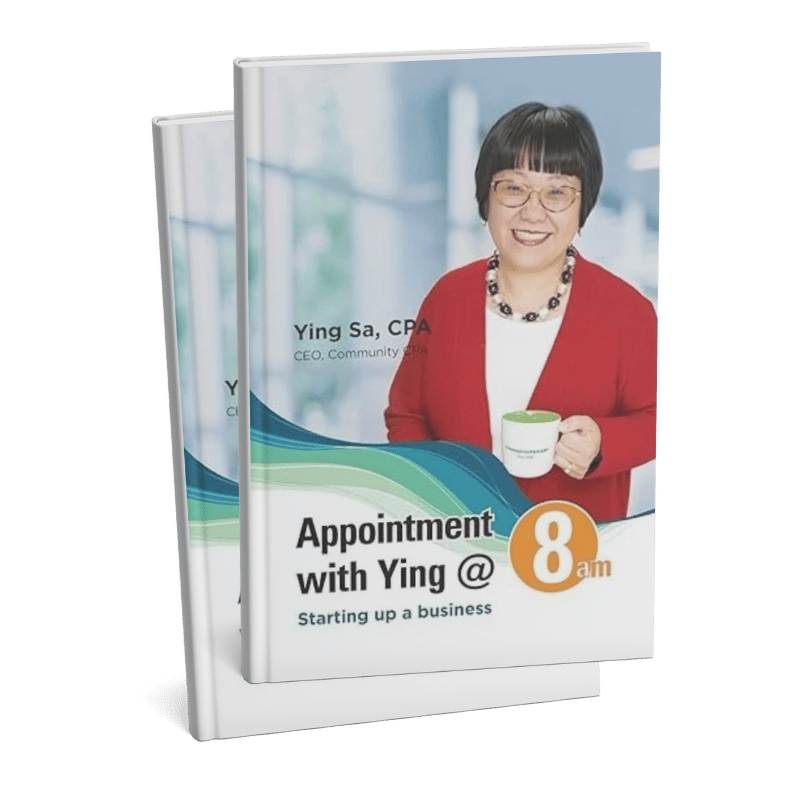

Ying shares her experience in business, drawing from the wisdom of meeting with over 15,000 clients. Her book series features the lifecycle of a business from startup to sunset.

Starting Up a Business

Growing Your Business

Check it out!

Get expert tips, industry news, and strategies to help you grow your business and build wealth, delivered straight to your inbox.

You have successfully joined our subscriber list.

Email: info@communitycpa.com

Fax: (515) 271-8889

Des Moines, Iowa

3816 Ingersoll Ave.

Call: (515) 288-3188

Mon-Sat 8:30 a.m. – 5:30 p.m. CST

Coralville, Iowa

2421 Coral Ct., Suite 1

Call: (319) 208-3712

Mon-Fri 8:30 a.m. – 5:30 p.m. CST

Minneapolis, Minnesota

8722 Lyndale Ave. S, Ste 104

Call: (612) 808-9418

Mon-Sat 8:30 a.m. – 5:30 p.m. CST

Des Moines Office: (515) 288-3188

Coralville Office: (319) 208-3712

Minneapolis Office: (612) 808-9418

California Office: (831) 218-4346

| Contact | Phone | |

|---|---|---|

| Dan Kim Onboarding Business Consultation Client service | 515-720-5872 | dan@communitycpa.com |

| Song Mo Spanish client services | 515-720-9234 | song@communitycpa.com |