Since 1998, Community CPA has served small to mid-sized businesses with their accounting, payroll, sales tax, tax, audit and business challenges. No matter how simple or complex the situation you are in, Community CPA offers business strategies and solutions that are easy to understand, and will help you implement it for business success.

Now in 2024, we heard from clients about their New Year goals for their business. Sharing their goals will supercharge it to become a reality, so we encouraged everyone to respond. What are your goals for 2024? How can Community CPA help? Reach out to us for a free Discovery Call to explore how to work with Community CPA!

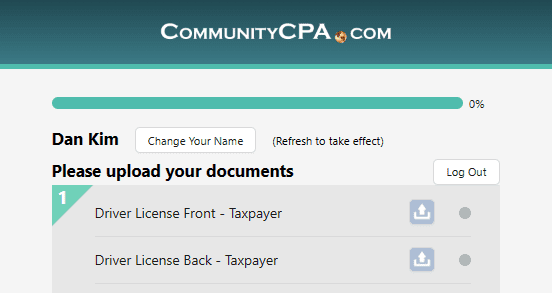

Are you looking to start services with Community CPA in 2024? If so, sending documents and getting started with us is easy. Click on "Onboard with Us" and create a new account, going through the Step-by-Step process of securely sending us the needed documents. We'll reach out to you to meet and finish setting up your account.

We offer monthly accounting, bookkeeping, and financial statements that provide an accurate picture of your business activity.

The efficiency of a specialist preparing and processing your payroll and paychecks, payroll tax liabilities, and quarterly reports.

Properly plan and perform a financial audit, single audit, internal audits, and attest services.

Federal, state, local and international taxes for individuals, business, nonprofits, trusts and more, implementing the latest tax strategies.

Services including business incorporation, business taxes and licenses, ERC, legal contracts, employment, and more.

Business technology consultation for streaming your business processes.

Join our YouTube Channel and subscribe for the latest in business trends and tips!

Since 2020 during the time of the pandemic, Community CPA has released regular videos at 3:00PM CST to help support the community with relevant business information. We continue this tradition with sharing free content with the community to help business owners who want to scale.

Community CPA & Associates Inc is not your average accounting firm. We offer expertise with empathy, knowledge, understanding, and powerful technology with a human touch.

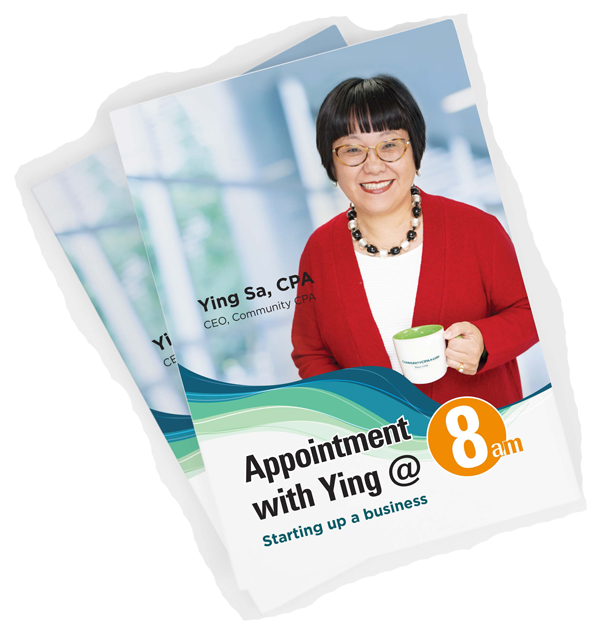

Ying shares her experience in business drawing from the wisdom of meeting with over 15,000 client appointments. Her book series will feature the lifecycle of a business from startup to sunsetting.

Starting up a Business

Growing Your Business

California

Office Hours:

Monday – Saturday | 8:30am – 5:30pm

Staff Login | Web Design and Development by Saltech Systems

Des Moines Office: (515) 288-3188

Coralville Office: (319) 208-3712

Minneapolis Office: (612) 808-9418

California Office: (831) 218-4346

| Contact | Phone | |

|---|---|---|

| Dan Kim Onboarding Business Consultation Client service | 515-720-5872 | dan@communitycpa.com |

| Song Mo Spanish client services | 515-720-9234 | song@communitycpa.com |

Email: info@communitycpa.com

Fax: (515) 271-8889

Des Moines, Iowa

3816 Ingersoll Ave.

Call: (515) 288-3188

Mon-Sat 8:30 a.m. – 5:30 p.m. CST

Coralville, Iowa

2421 Coral Ct. Suite 1

Call: (319) 208-3712

Mon-Fri 8:30 a.m. – 5:30 p.m. CST

Minneapolis, Minnesota

8722 Lyndale Ave. S

Call: (612) 808-9418

Mon-Sat 8:30 a.m. – 5:30 p.m. CST